We’re glad you stopped by.

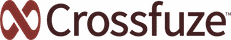

IT leaders (like you) at commercial banks (like yours) are facing mounting pressures to deliver highly intuitive, secure, and personalized services. According to Boston Consulting Group, financial institutions that digitize customer journeys can increase revenues by up to 20% and reduce costs by up to 25%. With this in mind, IT has no choice but to rethink how low-value work gets done so that they can shift their undivided attention to deeper thinking around innovating the customer journey.

We’ve helped banks around the world use ServiceNow to automate how work gets done, and we’re confident that we can do the same for you.

Transforming from a traditional IT Department to an Innovation Center takes guts, strategic planning, and the right tools and team to see your vision through to achievement. Crossfuze is here to help.